It would be true to say that Bitcoin Trading has enjoyed a real explosion. As far as popularity goes when we are talking about cryptocurrency. This very popular cryptocurrency has hit among investors, traders and consumers and everyone. Who is working to make a killing trading in Bitcoin.

It has so much to offer as far as lower fees, transaction speed, and increasing value. Which could be the reason why most people choose it for their trading. This is, however, a turbulent market and to make it big you need to be a very smart trader when selling and buying it. With dedication and discipline, you can turn Bitcoin volatility in your favor.

Here are simple but effective ways you can do just that.

Keep up with the latest Bitcoin news

- News items may not all have an impact on this currency, but the truth is that there are some items that could greatly influence its price.

- By gaining access to Bitcoin-related news and live news feed for typical news, you could end up catching something on time so you make decisions that will bring you good luck with your trading.

- It helps to always be up to date with Bitcoin news and other unexpected news that could have an impact on its performance.

Use stop losses to your advantage

- Whether you are just starting with your trading or you have been at it for a while, you need to be prepared for times when losses are inevitable.

- Nobody trades expecting to make a loss but the chances are always there hence the need to implement a reliable stop-loss plan.

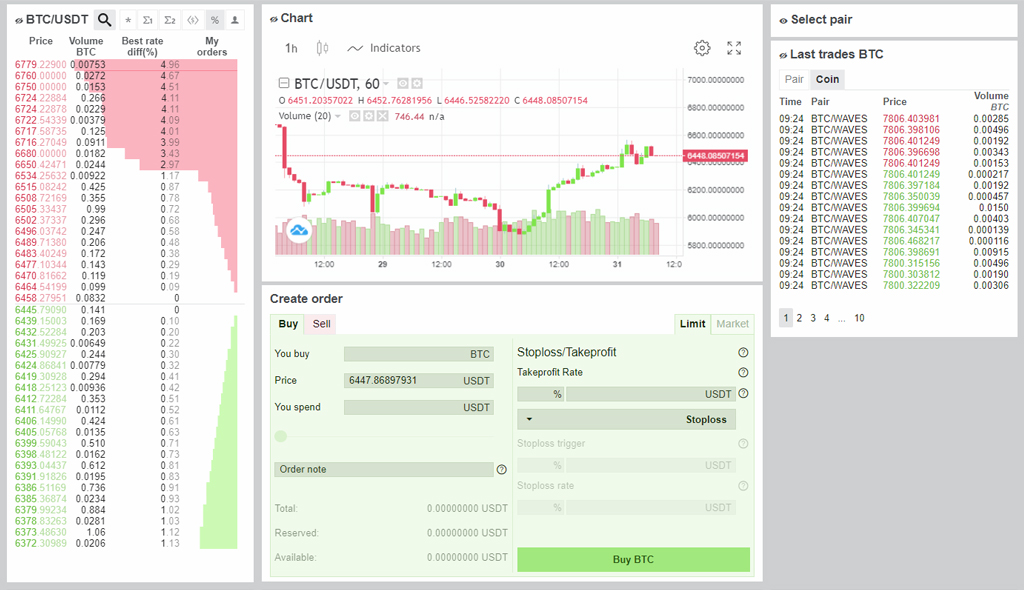

- The valuations fluctuate regularly and you need to be prepared for bad days. The market offers tools that you can automatically set to stop losses before they have severe impacts on your profits.

- Whether engaging in Bitcoin futures markets, CFD or cash, ensure that you use a stop loss to keep open positions protected.

Understand technical analysis inside out

- This is very important before joining the trade.

- Considering that there is no governing body or bank to influence the valuation of Bitcoin, you need to be your own judge in more ways than one.

- If you do not understand market fundamentals and you do not even know how to analyze price charts or read price actions and applying indicators you are doomed to make the wrong moves.

- Remember the price models are speculative largely making it important for you to know all technicalities that truly matter.

Be prudent with your leverage

- Leverage has the ability to boost your gains or magnify your losses too.

- If you are too much with your leverage then you will tend to be a little reckless with managing your money and this blows out the trading account at the end.

- On the other hand, being too careful with your leverage can hinder performance considering premium trades may not perform to full capabilities as expected.

- When it comes to Bitcoin trading, you need to do a balancing act to enjoy good returns.